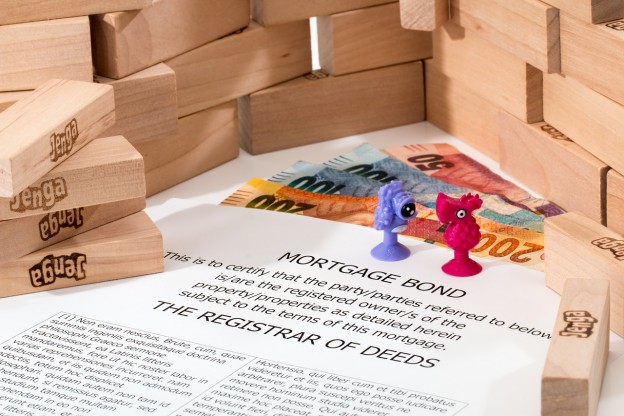

Do You Need Homeowners’ Insurance to Get Approved for a Mortgage?

Assets acquisition demands a tremendous amount of hard work and determination. Once you buy an asset such as a home or a rental property, you want protection from all possible losses.

Planning to buy a property? You need to know that lenders require borrowers to purchase adequate home insurance for the property in question. Technically, you do not have to carry insurance on a property you own free and clear. However, you want protection against any disaster that may come calling anytime.

1. The Mortgage Approval Process

Lenders carefully consider your application before deciding whether to approve your home loan or not. They pay attention to your credit score, income, loans you are currently paying, and expenses among other things.

If the lender believes you can pay the loan, it issues a conditional approval. The document contains terms and conditions of the mortgage loan. One of the requirements you need to fulfill is buying adequate homeowners insurance. You do not need to have home insurance to be approved. However, you will not close before you fulfill all conditions.

2. Why Do Lenders Require Homeowners to Carry Insurance?

When it comes to mortgages and other types of loans, lenders are always thinking about one thing: Risk. They will usually avoid risky borrowers. But bankers understand there are risks they cannot control. One example of such risks is a fire that damages your home. The lender wants to ensure you to have enough protection.

For the duration of the mortgage, you and your bankers co-own your home. They are an interested party. If a catastrophe destroys your home, the bankers risk losing their money — your property is an investment to them, too. Per Upside, your home insurance policy protects you and your lender against financial risk.

3. What Coverage Do I Need?

Standard homeowners insurance typically includes dwelling coverage, personal property coverage, and liability coverage. Some home insurance policies may also include loss of use coverage and other structures coverage. If your home is in an area where flooding and earthquakes are likely to occur, consider buying additional insurance to cover these risks. Your standard home insurance policy does not cover floods and earthquakes. For complete peace of mind, buy a cover that is as inclusive as possible.

Types of Home Insurance Coverage

- Dwelling coverage: Pays for repair or replacement of your home’s structure and any attachments.

- Personal property coverage: Protects your home’s contents.

- Loss of use coverage: The coverage pays for additional expenses you incur during home repair after damage.

- Liability Coverage: Protects you against liability related to accidents occurring on your property.

- Other structures coverage: Covers standalone structures such as a separate guest house.

If you are a property owner with tenants, consider buying real estate and landlord insurance. The coverage gives you protection against:

- Damage to your property

- Theft and malicious damage

- Loss of rent due to default or your property being uninhabitable

- Landlord’s liability

Real estate and landlord insurance also offer:

- Legal coverage in case of tenancy-related disputes

- Alternative accommodation for your tenants in an emergency

Consult your insurance agent to ensure you buy enough insurance that covers all risks related to property ownership.

Read More »